Beautiful Work Info About How To Avoid Paying Social Security Tax

Here's how to reduce or avoid taxes on your social security benefit:

How to avoid paying social security tax. You may also be able to defer rmds and thus avoid paying tax on social security benefits using a qualified longevity annuity contract or qlac. So if you need to tap your retirement savings for your expenses, taking some money from a roth can minimize the income included in the social security tax calculation. Income tax on that salary is not difficult.

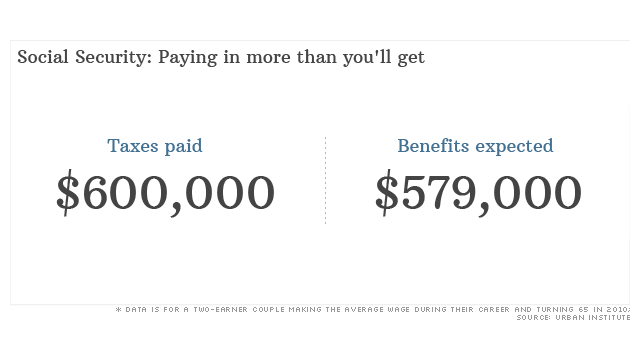

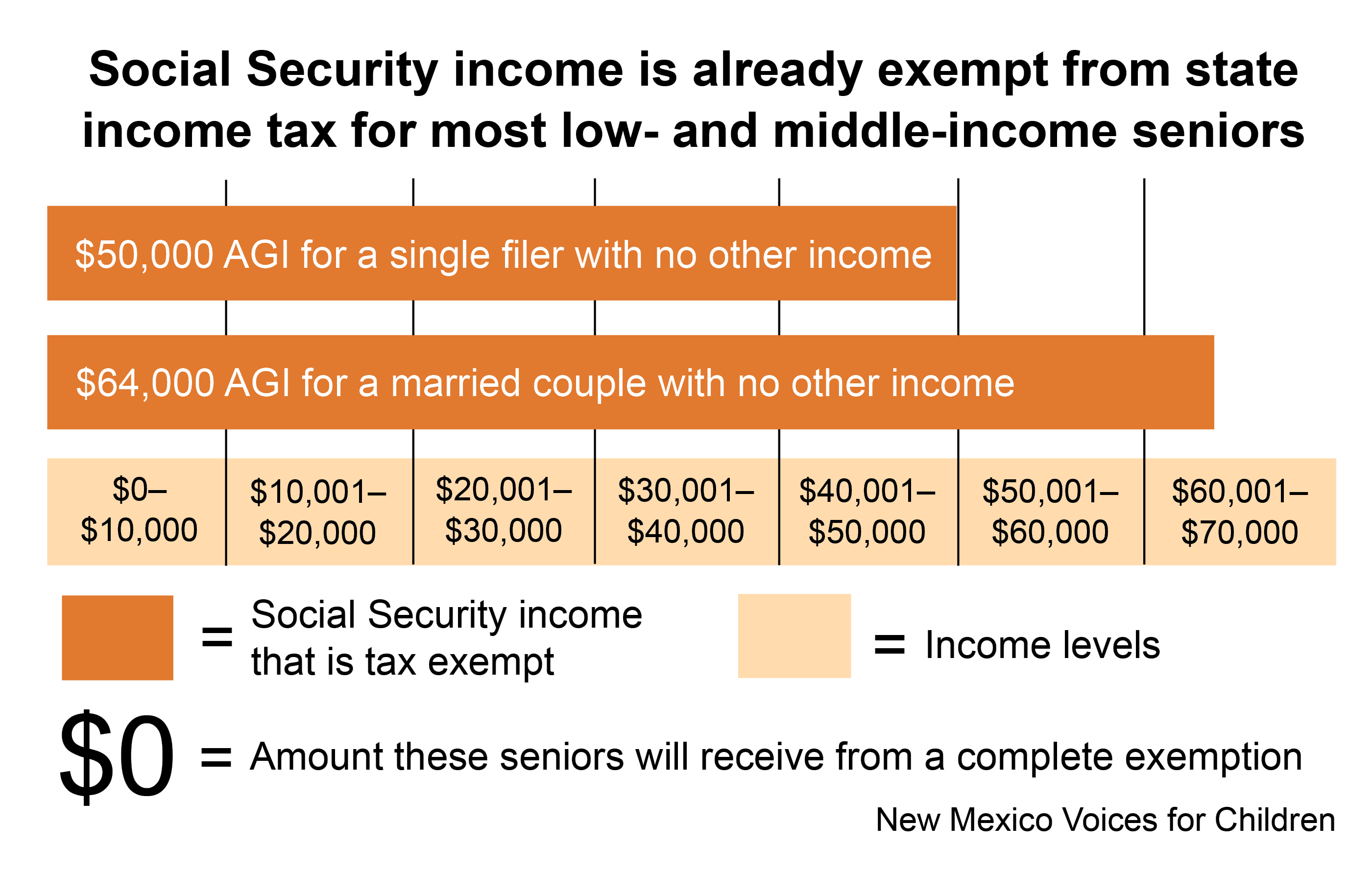

Social security benefits are included with other taxable income at the rate of 85%, 50%, or zero. It is possible to avoid taxes on social security benefits credit: Between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

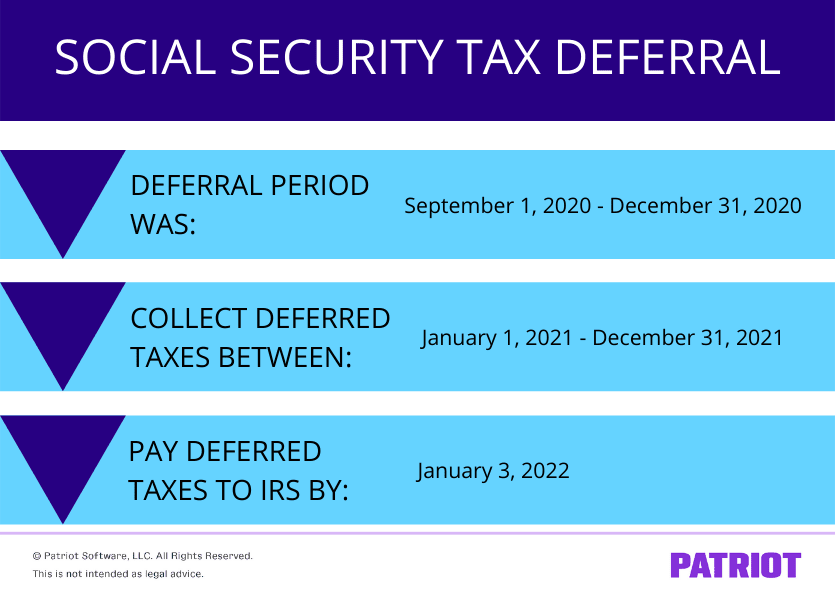

Making quarterly estimated tax payments during the year. Here's how to reduce or avoid taxes on your social security benefit: Both this year and next year, taxes will.

$6,200 in social security taxes you paid as an employee; One way is to claim the property as a second home, rather than an investment property. Manage your other retirement income sources.

Take these four steps to avoid these surprises in retirement. Your benefits are not taxed if your income falls below $32,000 (married filing. Some people who get social security must pay federal income taxes on their benefits.

However, no one pays taxes on more than 85% percent of their social security. If you depend on social security, those taxes can significantly lower your monthly deposits. Social security can be taxable, but there are strategies you can implement to make sure you never h.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

![Social Security Taxation [How To Avoid Paying Tax!] - Youtube](https://i.ytimg.com/vi/4scvBFeo09k/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/GettyImages-485008004-0fc1bd9ac96844daa818ab6b90fff5bf.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)