First Class Info About How To Settle Your Debt

Start low by offering to pay 30 percent or less of what you owe and negotiate your way to an amount that you and the collector can both agree upon.

How to settle your debt. Compare low interest personal loans up to $50,000. Otherwise, a settled account will appear on your credit report for up to 7.5 years from the date. Before you can negotiate a settlement or payment plan with the debt collector, you need several key pieces of.

You must pay a $186 application fee to apply. The percentage will depend on the creditor, the size of the debt, and. National debt relief is our highest rated debt consolidation company on all the parameters

As a rule of thumb, if your debt is less than $10,000, it’s usually best to contact the irs yourself to try to arrive at a payment agreement. Usually, this happens when you offer to settle. Ad unbiased expert reviews & ratings.

For example, $1,200 of monthly debt divided by $3,000 of monthly income is 0.4 x 100 = 40%. Another option that will keep your credit whole and help pay off your debt faster would be to simply pay more than the minimum payment. Be honest with yourself about how much you can pay each month.

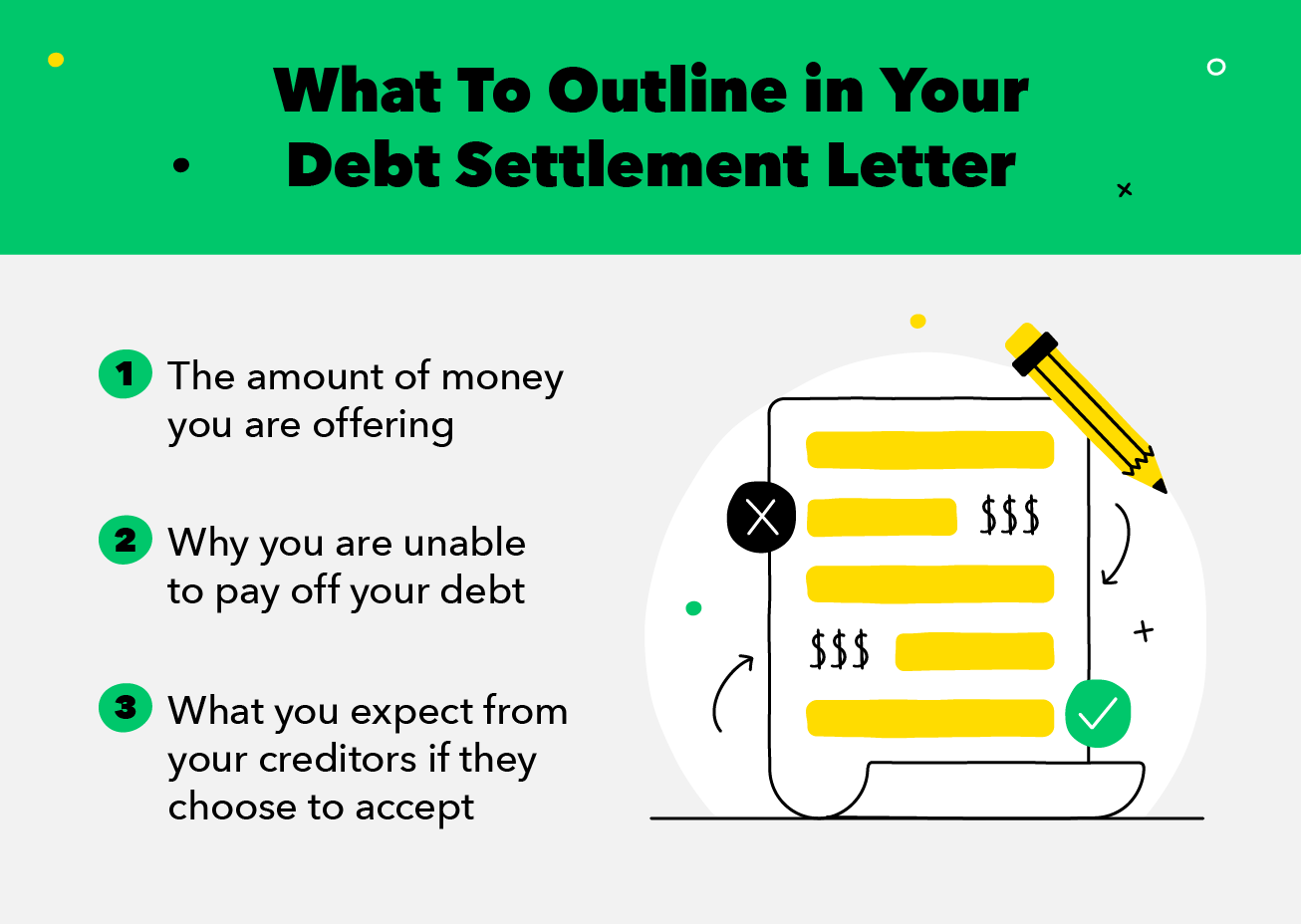

One newer irs program allows you to pay your tax debt in low monthly installments. Know the details about your debt before negotiating a settlement. Just because your creditors have already filed a case against you doesn’t mean you can’t pursue a debt settlement anymore.

How to settle tax debt step by step first, you apply for an offer in compromise (oic) using form 656. Will debt collectors settle for 30%? The partial payment installment agreement (ppia) lets you pay your irs tax debt.